https://www.bea.gov/research/papers/2006/comparing-price-measures-cpi-and-pce-price-index

연준은 CPI보다 PCE 물가지수를 선호하는데, 그 이유에 대해 간략하게 살펴 보자. 2006년 자료라 지금과 다른 부분이 있을 수 있다.

PCE 가격지수와 CPI 차이점 중에 주목할 만한 것은

1.PCE는 분기 단위로 비중이 바뀐다. CPI는 2년 단위로 비중이 교체되므로, PCE가 좀 더 신속하게 비중을 업데이트한다.

2.PCE는 가계가 직접 지출한 것 뿐만아니라 가계를 대신해 기업체가 지출한 항목도 포함한다. (ex) 의료비 ) CPI는 가계가 직접 지출한 것만 반영한다.

3.PCE는 피셔 지수 방식으로 계산되고, CPI는 라스파이레스 방식으로 계산된다.

피셔 지수는 라스파이레스 지수와 파셰 지수의 기하평균이라고 한다.

라스파이레스 방식의 경우 기준 시점 수량을 가중치로 고정하는데, 이 때문에 특정 재화 가격 상승에 따른 대체 효과를 반영하지 못하는 단점이 있다. (인플레이션 과대평가)

*클리브랜드 페이퍼에서는 PCE와 CPI 차이에 대한 부연 설명을 해주고 있다. 위의 내용의 반복이기도 하다.

et 20140417 pce and cpi inflation difference

The CPI and PCE each come in two flavors, a so-called “headline” measure and a core measure, which strips out the more volatile food and energy components. Over the short term, the core measure may give a more accurate reading of where inflation is hea

www.clevelandfed.org

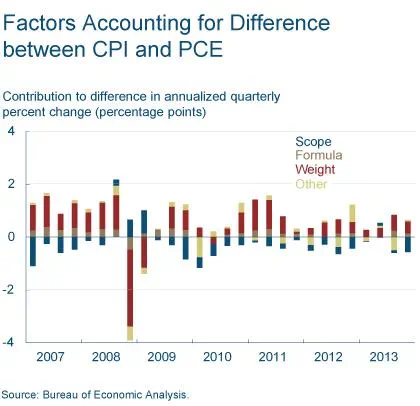

What accounts for the difference between the two measures? Both indexes calculate the price level by pricing a basket of goods. If the price of the basket goes up, the price index goes up. But the baskets aren’t the same, and it turns out that the biggest differences between the CPI and PCE arise from the differences in their baskets.

The first difference is sometimes called the weight effect. In calculating an index number, which is a sort of average, some prices get a heavier weight than others. People spend more on some items than others, so they are a larger part of the basket and thus get more weight in the index. For example, spending is affected more if the price of gasoline rises than if the price of limes goes up. The two indexes have different estimates of the appropriate basket. The CPI is based on a survey of what households are buying; the PCE is based on surveys of what businesses are selling.

Another aspect of the baskets that leads to differences is referred to as coverage or scope. The CPI only covers out-of-pocket expenditures on goods and services purchased. It excludes other expenditures that are not paid for directly, for example, medical care paid for by employer-provided insurance, Medicare, and Medicaid. These are, however, included in the PCE.

Finally, the indexes differ in how they account for changes in the basket. This is referred to as the formula effect, because the indexes themselves are calculated using different formulae. The details can get quite complicated, but the gist of the matter is that the PCE tries to account for substitution between goods when one good gets more expensive. Thus, if the price of bread goes up, people buy less bread, and the PCE uses a new basket of goods that accounts for people buying less bread. The CPI uses the same basket as before (again, roughly; the details get complicated).

2000년에 연준의 국회보고서에 왜 연준이 PCE를 CPI보다 선호하는지 내용이 나와있다 (볼드체 부분). 그린스펀이 직접 적은 건지는 모르겠다.

In past Monetary Policy Reports to the Congress, the FOMC has framed its inflation forecasts in terms of the consumer price index. The chain-type price index for PCE draws extensively on data from the consumer price index but, while not entirely free of measurement problems, has several advantages relative to the CPI.

The PCE chaintype index is constructed from a formula that reflects the changing composition of spending and thereby avoids some of the upward bias associated with the fixed-weight nature of the CPI. In addition, the weights are based on a more comprehensive measure of expenditures. Finally, historical data used in the PCE price index can be revised to account for newly available information and for improvements in measurement techniques, including those that affect source data from the CPI; the result is a more consistent series over time.

This switch in presentation notwithstanding, the FOMC will continue to rely on a variety of aggregate price measures, as well as other information on prices and costs, in assessing the path of inflation.

*수정이 용이하다는 점이 왜 좋은지는 사실 잘 와닿지 않는다.

'경제지표' 카테고리의 다른 글

| 주요국 GDP- 미국, 중국, 유럽 (0) | 2023.06.13 |

|---|---|

| NACM Credit Manager Index (0) | 2023.06.02 |

| 주택 시장 관련 지표 (0) | 2023.05.22 |

| Changes in Net Worth: Households and Nonprofit Organizations (0) | 2023.05.16 |

| 가계 및 비금융 기업 수시입출식 예금 (0) | 2023.05.16 |